Accounts Payable facilitates improved cash flow and relationships with suppliers by providing timely, accurate and efficient control over invoice processing, bill payments, analysis of available discounts and tracking of purchases.

The Accounts Payable system provides an efficient method for recording purchases and supplier invoices as well as making expense distributions.

Included are facilities for maintaining, verifying and reporting supplier account information. The module offers optional two-step invoice entry that allows users to enter, approve and then pay an invoice.

Extensive audit trails and journals form an integral part of the module. Against each supplier, invoice and transaction details are retained from which cash requirements,

forecasting and purchase analysis may be printed.

Suppliers can be held in local or foreign currency and paid in alternate currencies.

Multi-branch accounting is available, and free-format checks and remittances can be designed.

Accounts Receivable improves receivables management by facilitating accurate invoice processing and ageing, timely statement delivery and revenue collection as well as efficient credit management.

This in turn leads to improved cash flow and customer relationships.The Accounts Receivable system provides users with extensive control of customer and credit management information. Analysis and reporting can be performed on an open-item or balance-forward basis using various ageing options.

Information for a defined series of related customers may be accumulated into a single master account for consolidated statement printing. In addition, free-format statements and recurring invoices can be designed. Receivables can be held in a local or foreign currency, while payment can be received in an alternate currency, and the system complies with European Monetary Union (EMU) requirements

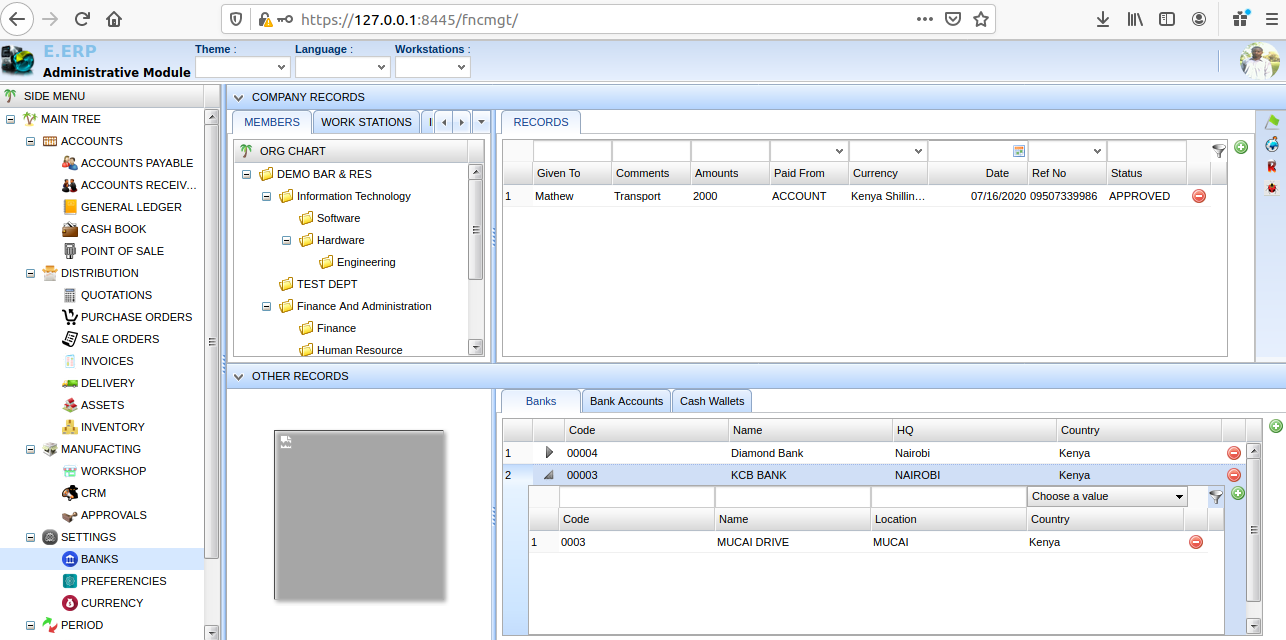

Einskarp General Ledger facilitates the management of corporate performance and the monitoring of return on investment by providing complete enterprise-wide financial recording, analysis and reporting from all aspects of the business.

The system’s extensive drill-down capabilities enable you to view everything from detailed journal entries to original source documents.

General Ledger produces the enterprise’s financial statements, including: the Balance Sheet, which shows the enterprise’s assets, liabilities and equity at a point in time; the Income Statement, which shows the enterprise’s income, expenses and net profit over a period of time; the Cash Flow Statement, which shows sources and applications of cash; and associated financial reports such as the Trial Balance.

Cash Book allows optimal cash management by providing system-wide bank reconciliation, as well as tracking information on cash inflows and outflows.

Cash Book is part of the set of financial analysis solutions provided by Einskarp to enable managers to forecast and perform what-if analysis on financial data.

It provides a daily means of recording details about sundry deposits and withdrawals, maintaining Cash Book bank balances, reconciling and adjusting entries, and printing online checks.

Entries can be posted manually or automatically and the amounts can be distributed to a number of ledger accounts, including those belonging to other companies. The Cash Book system allows you to set up multiple banks in both local and foreign currency.

In addition, you can produce online checks and remittances, bank reconciliation statements, consolidated statements and a bank balance report. An electronic bank reconciliation facility is also available.

Einskarp Point of Sale offers an easy-to-use interface to companies using Einskarp ERP enabling them to collect and control the payment of direct consumer sales.

Einskarp Point of Sale is a fully-integrated software solution that facilitates over-the-counter sales transactions by accepting payments or deposits efficiently. It is used to sell stock directly to a customer and enables immediate stock allocation and payment as it is done at the point of transaction.

Einskarp Point of Sale is not just a replacement for the electronic cash register – because it is fully integrated to the Einskarp ERP back office it offers the advantages of a safe and secure cash collection process, controlled through an end-of-day process that is fully integrated to the back office financials in Einskarp ERP, no additional journals or reconciliations are required.

Complete on- and offline trading functionality which means that should your network or server go down, your Point of Sale system simply keeps on working without any interruptions. After all, cash is key to your business, so you need a proven and powerful point-of-sale solution that works as hard as you do

Quotations provides the flexibility to produce quotes with multiple offers on stocked and/or customized (estimated) items for existing and prospective customers.

The power of this system becomes evident when one or more stock items must be specially made; in which case a supporting estimate can be created.

This, in turn, may have one or more special parts, which again can be supported by an estimate, and so on. This process can be extended to 14 levels that are rolled up to complete the quotation’s top-level costing.

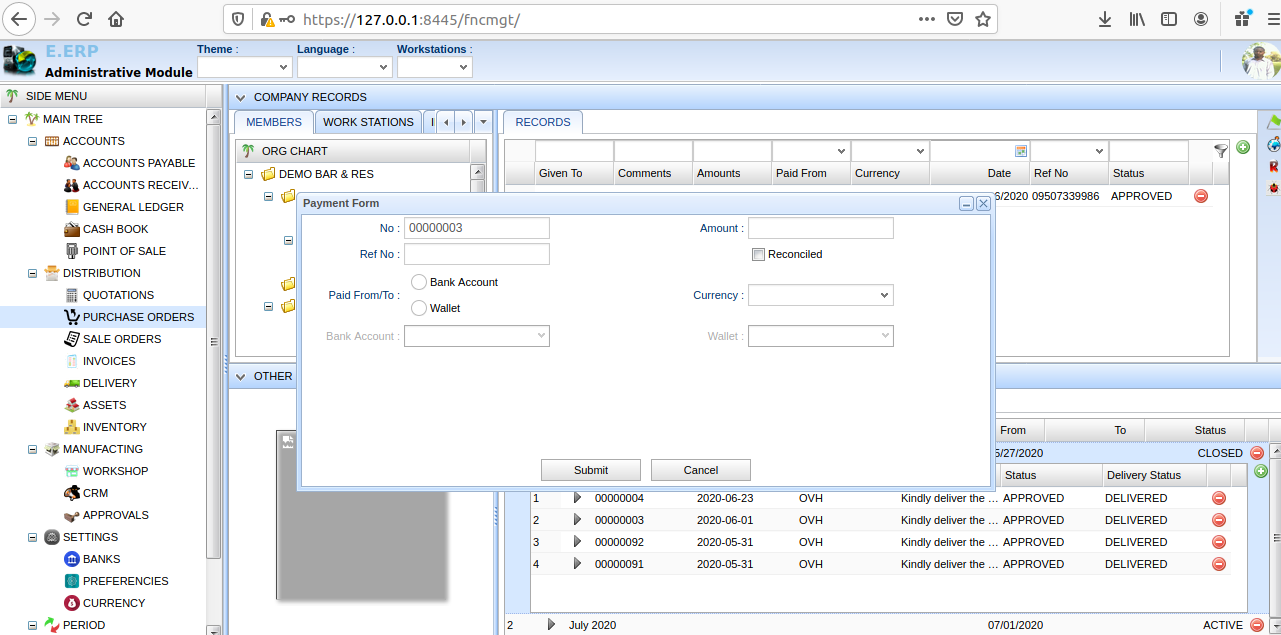

Purchase Orders is an integral part of the organization’s distribution and manufacturing functions. It enables the monitoring of the quality, accuracy, lead times and cost of purchases, while providing comprehensive supplier performance analysis.

The Purchase Order module includes a Preferred Supplier solution to manage the processes and policies that deal with the sourcing of goods and services during your purchasing cycle;

Goods Received Notes (GRN) Suspense System for Accounts Payable invoice matching; a Requisition System; and a Supplier’s Performance report, along with currency options.

Sales Orders enhances customer service through fast, efficient order processing and accurate, timely order fulfilment while maximizing sales productivity with instant access to information on stock availability, prices and product substitutions. Additionally, customer account information can be accessed to streamline the ordering process, for status, credit limits, previous orders, and to confirm the customer’s billing and shipping addresses.

You send bills to your customers and you want them paid quickly -- that's why efficiency in your billing process is key. Ultimately, the quicker your business can get invoices to customers and clients, the faster your business will be paid, which will have a positive impact on cash flow.

Delays in payments can even put your business at stake.

A credit note is issued to reduce the amount of money in the invoice.

It is issued when a customer returns goods that had already been invoiced, it can be issued to capture a discount that was previously omitted or just to correct an overstated invoice.

A debit note is a document used by a vendor to inform the buyer of current debt obligations, or a document created by a buyer when returning goods received on credit.

The debit note can provide information regarding an upcoming invoice or serve as a reminder for funds currently due. For returned items, the note will include the total anticipated credit, an inventory of the returned items, and the reason for their return.

Keep track of goods on transit or shipped to various destinations. This module will enable to capture delivery Mode,

Delivery Date, Shipping Company, etc for goods delivered to or outside your company

Assets Register solution provides up-to-date, real-time information pertaining to the value of all assets within the organization by keeping a record of depreciation and current asset values.

It also contains a facility which evaluates the remaining worth by tracking income and expenditures derived from assets.

The Assets Register system enables you to manage and control your non-current assets in terms of wear-and-tear depreciation, book value, disposals, additions, and re-valuations.

The information contained in the Assets Register can integrate with the General Ledger or be run standalone. You can optionally record costs incurred in the maintenance of assets against the relevant individual asset.

Subscribe today to get our latest news in what is trending in the world of technology